Is Medical Marijuana Deductible on Your Taxes?

by Haley Mills · September 30, 2022

Medical marijuana is now legal in many states, but is it tax deductible? Here’s what you need to know.

In the United States, medical marijuana programs have been legalized in 37 states and the District of Columbia, Puerto Rico, Guam, and the U.S. Virgin Islands.

Medical marijuana programs allow patients with specified conditions to own, grow and utilize cannabis products to aid in managing their condition, even if recreational cannabis users are not authorized in that state.

As a medical cannabis patient, you may wonder if your medical marijuana purchases are deductible on your tax return or if there are any dispensary tax deductions. Let’s find out!

The Basics of Marijuana Taxes

Is marijuana legal? Not according to federal law. Since cannabis is still federally prohibited, there’s no one-size-fits-all approach to medical marijuana taxes.

However, states and local jurisdictions can tax weed under their regulations and decided percentages.

Tax revenue is regularly an argument pro-marijuana lobbyists use when attempting to influence a vote for legalization.

Three types of Cannabis Taxes:

There are three main types of cannabis tax: excise taxes, local sales taxes, and state-wide sales taxes on recreational and medical marijuana sales.

Excise Tax

A cannabis excise tax is collected on certain goods like tobacco, beer, and marijuana. Excise taxes are sometimes called “sin taxes” because they are separate from local and sales taxes. Most states pass the excise tax for the retail sale of weed to the consumer.

State-wide Sales Tax

In most states, sales taxis on consumer receipts for retail sales of goods and services. Marijuana sales are taxed similarly. The state sales tax rate varies by location.

Local Sales Tax

Counties or municipalities impose local taxes to fund approved community programs. States like Alaska, California, Massachusetts, New York, Oregon, and Virginia allow local governments to collect additional tax on cannabis purchases, so the local tax rates vary by location.

What Is a Gross Receipts Tax?

A gross receipts tax is applied to a business’s gross sales without deductions for products sold or compensation. Dispensaries pay a gross receipts tax on adult-use sales.

States that DO Tax Medical Marijuana

While states like California and Illinois allow medical marijuana as a tax write-off for certain patients, most other states follow federal law and the IRS and do not allow medical marijuana to be deducted from individual or business income taxes.

- Arizona: 6.6%state excise tax and 2-3% optional local tax.

- Arkansas: 6.5% statewide sales tax, 4% privilege tax, and applicable local taxes.

- California: 15% cannabis excise tax and local taxes

- Colorado: 2.9% state excise tax and additional local taxes.

- Connecticut: statewide retail sales tax of 6.35%.

- Florida: statewide retail sales tax of 6%.

- Hawaii: statewide retail sales tax of 4%; Oahu-tax rate of 4.5%.

- Illinois: 1% statewide sales tax.

- Iowa: 6% statewide retail sales tax and applicable local taxes.

- Maine: 5.5% statewide sales tax. Edibles are taxed at 8%.

- Michigan: 6% statewide sales tax.

- Missouri: 4% statewide sales tax.

- Montana: medical marijuana 4 percent excise tax.

- Nevada: 4.6% statewide sales tax.

- New York: 7% medical use marijuana excise tax

- North Dakota: 5% statewide sales tax.

- Ohio: statewide sales tax, varying between 6.5% and 7.25% by county

- Oklahoma: statewide sales tax of 4.5%, local taxes, and a medical cannabis excise tax of 7%.

- Rhode Island: 7% statewide sales tax.

- Washington, D.C.: 5.75% sales tax.

States that DO NOT Tax Medical Marijuana

The following states do not perform tax collection on medical marijuana sales, health care, or qualifying drugs:

- Alaska

- Delaware

- Louisiana

- Maryland

- Massachusetts

- Minnesota

- New Hampshire

- New Jersey

- Oregon

- Pennsylvania

- Utah

- Vermont

- Washington

Recreational Marijuana Taxes By State

Alaska

Adult-use retail: No statewide cannabis tax; some municipalities charge a cannabis excise tax. Anchorage, Mat-Su Borough, Fairbanks, and Ketchikan have a 5% excise tax. Juneau collects 3%.

Arizona

Adult-use retail: 16% cannabis excise tax and a 5.6% statewide retail sales tax, bringing the total to 21.6%.

California

Adult use retail: statewide 15% cannabis excise tax, a state retail sales tax of 7.25%, and local sales tax of up to 1%. Local municipalities can add a business tax of up to 15%.

Colorado

Adult-use retail: 15% cannabis excise tax and additional local taxes.

Illinois

Adult-use retail: Marijuana tax rates in Illinois are primarily based on THC content. Typically, the higher the THC content, the higher the tax rate.

- Edibles come with a 20% marijuana excise tax.

- Cannabis products containing 35% THC or less have a 10% excise tax.

- Cannabis products containing more than 35% THC have a 25% excise tax.

- 6.25% statewide retail sales tax

Maine

Adult-use retail: 10% marijuana excise tax; statewide 5.5% sales tax.

Massachusetts

Adult-use retail: 10.75% marijuana excise tax; 6.25% sales tax; potential local excise tax of up to 3%.

Michigan

Adult uses retail: 10% marijuana excise tax; statewide 6% sales tax.

Montana

Adult use retail: 20% marijuana excise tax.

Nevada

Adult use retail: Purchases are subject to a 10% cannabis excise tax, plus the 4.6% statewide sales tax. Out the door, expect roughly 15% added to your purchase for taxes.

New Jersey

Adult use retail: 6.625% statewide sales tax; Local municipalities can add a 2% sales tax.

New Mexico

Adult-use retail: 12% excise tax that will increase by 1% annually starting in 2025 and a gross receipt tax from 5-9%.

Oregon

Adult-use retail: 17% cannabis excise tax; 3% local municipal tax.

South Dakota

Adult use retail: South Dakota voters passed Amendment A in November. If the bill goes through, adult-use sales will have a 15% marijuana excise tax and a statewide 4.5% sales tax.

Vermont

Adult use retail: 14% cannabis excise tax; 6% statewide sales tax.

Virginia

Adult use retail: 21% state cannabis excise tax; statewide 5.3% sales tax

Washington

Adult use retail: 37% marijuana excise tax.

Marijuana Tax Revenue for the Government

States that have legalized adult-use cannabis have generated more than $3.7 billion in tax revenue from recreational cannabis sales in 2021, a report from the Marijuana Policy Project (MPP) that was released on Wednesday found.

That’s a 34 percent increase compared to revenue in 2020. Many states have taken these funds to put back into the community via educational programs, community outreach, and substance abuse prevention.

The impact of the growing marijuana industry is so prevalent that the U.S. Census Bureau plans to gather and study data regarding how states use the money to improve their infrastructure and social programming with revenue from cannabis companies.

This data type will lead to more cannabis jobs and hopefully encourage federal legalization.

- In Alaska, fifty percent of adult-use cannabis sales revenue “is invested in the Recidivism Reduction Fund and supports reentry programs for currently and formerly incarcerated individuals.”

- California has distributed more than 100 million USD to community groups and local nonprofit programs that benefit people adversely impacted by punitive drug laws.

- Colorado public schools have benefitted from a nearly 500 million USD investment in cannabis tax revenue.

- Illinois dedicates a percentage of its tax revenue to mental health services and local organizations that uplift disadvantaged communities. The state’s 2021 cannabis tax revenue outpaced that of alcohol by 100 million USD.

- Washington State funnels more than half of every 1 billion USD in cannabis tax revenue into public health initiatives, including a fund that provides health insurance for low-income families.

Ways to Save Money on Cannabis

Here are a few of our tips for saving money on weed:

Home Cultivation

Growing your own cannabis plants is a long-term commitment, but the rewards are worth the time when you’re trying to save hard-earned cash on that green flower.

Be sure to research how to grow weed before you begin. The cost-effective method of home growing is an incredibly efficient way to save weed and money.

Dispensary deals

When shopping for dispensary deals, there are a few ways to get the most weed for your money. Most dispensaries run weekly deals when you choose strains specifically for sale. They may even offer a program that matches a nearby store giving discounts.

It’s also a great idea to ask if there are loyalty programs or possible deals on shakes, seeded marijuana, gram pre-rolls, or any other discounted products.

Online dispensary trips usually include an offer to discount your first order. Take advantage of that. Usually, companies will offer ten to thirty percent off for your email address and possibly even a free gift with a purchase altogether.

Buy larger quantities

Buying in bulk is a way to significantly reduce spending. Typically, dispensaries will provide bulk buy discounts and wholesale sales prices if you purchase a certain quantity or more, so it may be in your best interest to purchase about an ounce instead of seven grams.

Online deals also include free shipping on weed, reducing the purchase price you will spend for delivery to your door.

Buying more may result in a more significant investment upfront, but it will also help you stay within your monthly spending limit and get your goods at a lower rate than the average retail price.

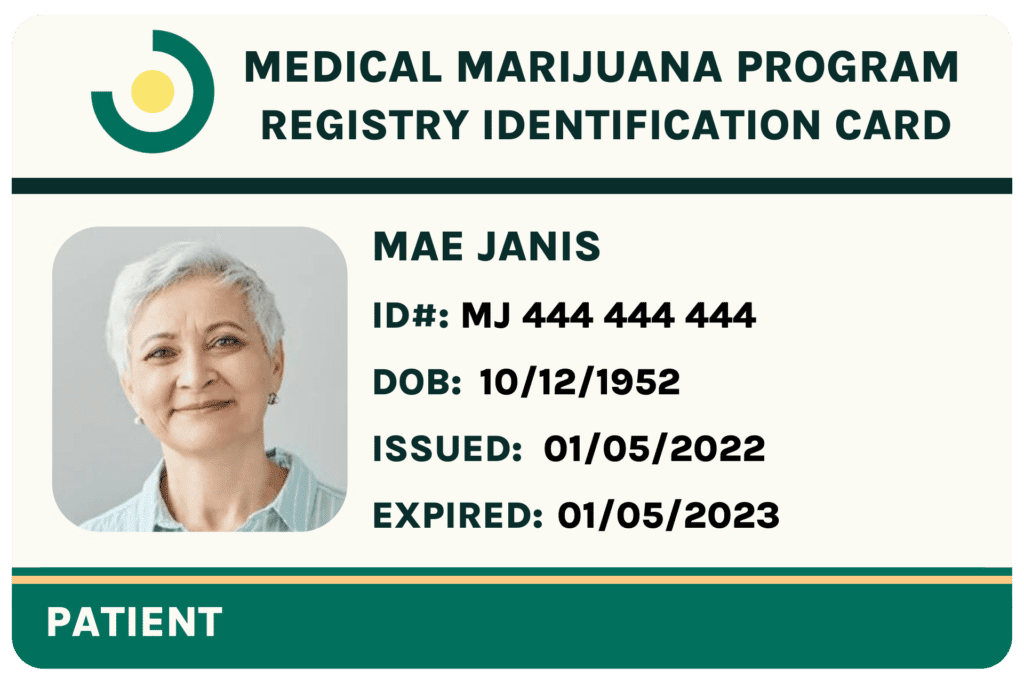

Medical Marijuana Card

Medical marijuana patients tend to receive better deals and higher quality products, even in states that allow recreational marijuana sales. It can be highly beneficial to obtain a medical marijuana card for this reason.

Let’s take a look at the Leafy DOC medical marijuana process:

- Book appointment. Skip unnecessary trips to the doctor’s office and make your appointment from the comfort of your home. Provide basic medical history and book your appointment.

- Match with a physician. Connect with the right doctor for you and easily talk to your provider on your phone or tablet. The provider will evaluate your condition and will address your questions.

- Receive your medical card and begin making medical marijuana purchases from licensed dispensaries. You’ll receive a Physician’s certification, and the Leafy DOC team will be available to address any questions you may have and support your upgraded lifestyle. If you are not approved for the card, there is a money-back guarantee.

Loyalty and Reward Programs

Companies such as Leafy Rewards offer cashback on cannabis purchases. When you sign up for the rewards program, you have three ways to earn rewards:

- In-store purchases

- Online purchases

- Download the mobile app

Leafy Rewards not only provides customers with the opportunity to earn cashback on cannabis purchases from their favorite brands, but it can also connect you with online and local offers from favorite dispensaries and cannabis supply stores around the U.S.

This may help to combat some of the hefty cannabis tax rates in your state.

The Bottom Line

When it comes to filing a tax return and including your medical marijuana expenses in your deductions, things can get a bit challenging. As we have discussed, cannabis is still federally illegal, which means regulations are very much state-by-state and case-by-case basis.

We know the federal IRS does not allow tax deductions for cannabis because it is still prohibited by the federal government. We recommend discussing with a tax professional and becoming familiar with your state and local marijuana tax rates and laws.

Last Updated: January 29, 2025

Get Approved for Your Medical Marijuana Card in Minutes!

Get Your Medical Card

Connect with a licensed physician online in minutes

Like This Article?

Share with your friends

Table of Contents

Keep Reading

-

Can You Be A Teacher With A Medical Marijuana Card?

Learn if medical marijuana card holders can become teachers. Discover the limitations and requirements, and find out if it’s possible!

-

5 Best Weed for Nausea Relief: Effective Strains to Try

Explore the best weed for nausea relief with top strains that effectively alleviate symptoms.

-

Your Step-by-Step Medical Marijuana Application Process

Navigate your medical marijuana application with this step-by-step guide for success.